Our package starts at Php 3,500.00/month. Inquire now and our representatives will get in touch with you for assessment of your needs.

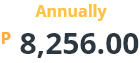

Additional Packages - Without Employees

Professional

Sole Proprietor

Partnership/Corp.

Monthly PF STARTS AT

3,500.00

5,000.00

8,000.00

• Monthly Remittance Form for Creditable Income Taxes Withheld Expanded (Form 0619E)

• Quarterly Remittance Return of Creditable Income Taxes Withheld Expanded (Form 1601EQ)

• Quarterly Alphalist of Payees (Alphalist)

• Issued Certificate of Creditable Tax withheld at Source (Form 2307)

• Annual Information Return of Creditable Income Taxes Withheld (Expanded)(Form 1604E)

• Quarterly Percentage Tax Return (Form 2551Q)

• Monthly VAT Declaration(Form 2550M)

• Quarterly VAT Declaration(Form 2550Q)

• Quarterly Income Tax Return for Individual (Form 1701Q)

• Quarterly Income Tax Return for Corporation, Partnership & Other Non-Individual Taxpayers (Form 1702Q)

• Annual Income Tax Return for Individual (Form 1701/1701A)

• Annual Income Tax Return for Corporation, Partnership & Other Non- Individual Taxpayers (Form 1702)

• Annual Registration Fee (Form 0605)

• Annual Registration Update - 8 Percent (8%) IT

• Cash Disbursements Book

• Subsidiary Sales Journal

• Subsidiary Purchase Journal

• Statement of Financial Position

• Statement of Comprehensive Income

• Statement of Changes in Capital / Equity

• Statement of Cash Flows

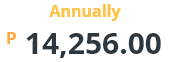

Additional Packages - Without Employees

Professional

Sole Proprietor

Partnership/Corp.

Monthly PF STARTS AT

5,000.00

8,000.00

13,500.00

• Monthly Remittance Form for Creditable Income Taxes Withheld Expanded (Form 0619E)

• Quarterly Remittance Return of Creditable Income Taxes Withheld Expanded (Form 1601EQ)

• Quarterly Alphalist of Payees (Alphalist)

• Issued Certificate of Creditable Tax withheld at Source (Form 2307)

• Annual Information Return of Creditable Income Taxes Withheld (Expanded)(Form 1604E)

• Quarterly Percentage Tax Return (Form 2551Q)

• Monthly VAT Declaration(Form 2550M)

• Quarterly VAT Declaration(Form 2550Q)

• Quarterly Income Tax Return for Individual (Form 1701Q)

• Quarterly Income Tax Return for Corporation, Partnership & Other Non-Individual Taxpayers (Form 1702Q)

• Annual Income Tax Return for Individual (Form 1701/1701A)

• Annual Income Tax Return for Corporation, Partnership & Other Non- Individual Taxpayers (Form 1702)

• Annual Registration Fee (Form 0605)

• Annual Registration Update - 8 Percent (8%) IT

• Cash Disbursements Book

• Subsidiary Sales Journal

• Subsidiary Purchase Journal

• Statement of Financial Position

• Statement of Comprehensive Income

• Statement of Changes in Capital / Equity

• Statement of Cash Flows

Additional Packages - With Employees

Professional

Sole Proprietor

Partnership/Corp.

Monthly PF STARTS AT

3,899.00

6,888.00

10,888.00

• Submission of Payroll Worksheet

• Monthly Remittance Return of Income Taxes Withheld on Compensation (Form 1601C)

• Annual Information Return of Income Taxes Withheld on Compensation (Form 1604C)

• Certificate of Compensation Payment/Tax Withheld for Compensation (Form 2316)

• Monthly Remittance Form for Creditable Income Taxes Withheld Expanded (Form 0619E)

• Quarterly Remittance Return of Creditable Income Taxes Withheld Expanded (Form 1601EQ)

• Quarterly Alphalist of Payees (Alphalist)

• Issued Certificate of Creditable Tax withheld at Source (Form 2307)

• Annual Information Return of Creditable Income Taxes Withheld (Expanded)(Form 1604E)

• Quarterly Percentage Tax Return (Form 2551Q)

• Monthly VAT Declaration(Form 2550M)

• Quarterly VAT Declaration(Form 2550Q)

• Quarterly Income Tax Return for Individual (Form 1701Q)

• Quarterly Income Tax Return for Corporation, Partnership & Other Non-Individual Taxpayers (Form 1702Q)

• Annual Income Tax Return for Individual (Form 1701/1701A)

• Annual Income Tax Return for Corporation, Partnership & Other Non- Individual Taxpayers (Form 1702)

• Annual Registration Fee (Form 0605)

• Annual Registration Update - 8% IT

• Cash Disbursements Book

• Subsidiary Sales Journal

• Subsidiary Purchase Journal

• Statement of Financial Position

• Statement of Comprehensive Income

• Statement of Changes in Capital / Equity

• Statement of Cash Flows

Additional Packages - With Employees

Professional

Sole Proprietor

Partnership/Corp.

Monthly PF STARTS AT

6,888.00

10,888.00

15,888.00

• Submission of Payroll Worksheet

• Monthly Remittance Return of Income Taxes Withheld on Compensation (Form 1601C)

• Annual Information Return of Income Taxes Withheld on Compensation (Form 1604C)

• Certificate of Compensation Payment/Tax Withheld for Compensation (Form 2316)

• Monthly Remittance Form for Creditable Income Taxes Withheld Expanded (Form 0619E)

• Quarterly Remittance Return of Creditable Income Taxes Withheld Expanded (Form 1601EQ)

• Quarterly Alphalist of Payees (Alphalist)

• Issued Certificate of Creditable Tax withheld at Source (Form 2307)

• Annual Information Return of Creditable Income Taxes Withheld (Expanded)(Form 1604E)

• Quarterly Percentage Tax Return (Form 2551Q)

• Monthly VAT Declaration(Form 2550M)

• Quarterly VAT Declaration(Form 2550Q)

• Quarterly Income Tax Return for Individual (Form 1701Q)

• Quarterly Income Tax Return for Corporation, Partnership & Other Non-Individual Taxpayers (Form 1702Q)

• Annual Income Tax Return for Individual (Form 1701/1701A)

• Annual Income Tax Return for Corporation, Partnership & Other Non- Individual Taxpayers (Form 1702)

• Annual Registration Fee (Form 0605)

• Annual Registration Update - 8% IT

• Cash Disbursements Book

• Subsidiary Sales Journal

• Subsidiary Purchase Journal

• Statement of Financial Position

• Statement of Comprehensive Income

• Statement of Changes in Capital / Equity

• Statement of Cash Flows

Other Industry

Lending / Franchising - Without Employees

Sole Proprietor

Partnership/Corp.

Monthly PF STARTS AT

5,000.00

10,000.00

• Monthly Remittance Form for Creditable Income Taxes Withheld Expanded (Form 0619E)

• Quarterly Remittance Return of Creditable Income Taxes Withheld Expanded (Form 1601EQ)

• Quarterly Alphalist of Payees (Alphalist)

• Issued Certificate of Creditable Tax withheld at Source (Form 2307)

• Annual Information Return of Creditable Income Taxes Withheld (Expanded)(Form 1604E)

• Monthly Remittance Form for Final Income Taxes Withheld (Form 0619F)

• Quarterly Remittance Return of Final Income Taxes Withheld (Form 1601FQ)

• Issued Certificate of Final Tax withheld at Source (Form 2306)

• Quarterly Alphalist of Payees (Alphalist)

• Annual Information Return of Income Payment Subjected to Final Withholding Taxes (Form 1604F)

• Quarterly Percentage Tax Return (Form 2551Q)

• Monthly VAT Declaration(Form 2550M)

• Quarterly VAT Declaration(Form 2550Q)

• Quarterly Income Tax Return for Individual (Form 1701Q)

• Quarterly Income Tax Return for Corporation, Partnership & Other Non-Individual Taxpayers (Form 1702Q)

• Annual Income Tax Return for Individual (Form 1701/1701A)

• Annual Income Tax Return for Corporation, Partnership & Other Non- Individual Taxpayers (Form 1702)

• Annual Registration Fee (Form 0605)

• Annual Registration Update - 8% IT

• Cash Disbursements Book

• Subsidiary Sales Journal

• Subsidiary Purchase Journal

• Statement of Financial Position

• Statement of Comprehensive Income

• Statement of Changes in Capital / Equity

• Statement of Cash Flows

SEC Reportorial Requirements

• Special Form of Interim Financial Statements for Lending Company (June and December)

• Special Form of Financial Statements for Lending Company (based on audited financial statements)

Other Industry

Lending / Franchising - Without Employees

Sole Proprietor

Partnership/Corp.

Monthly PF STARTS AT

8,000.00

15,000.00

• Monthly Remittance Form for Creditable Income Taxes Withheld Expanded (Form 0619E)

• Quarterly Remittance Return of Creditable Income Taxes Withheld Expanded (Form 1601EQ)

• Quarterly Alphalist of Payees (Alphalist)

• Issued Certificate of Creditable Tax withheld at Source (Form 2307)

• Annual Information Return of Creditable Income Taxes Withheld (Expanded)(Form 1604E)

• Monthly Remittance Form for Final Income Taxes Withheld (Form 0619F)

• Quarterly Remittance Return of Final Income Taxes Withheld (Form 1601FQ)

• Issued Certificate of Final Tax withheld at Source (Form 2306)

• Quarterly Alphalist of Payees (Alphalist)

• Annual Information Return of Income Payment Subjected to Final Withholding Taxes (Form 1604F)

• Quarterly Percentage Tax Return (Form 2551Q)

• Monthly VAT Declaration(Form 2550M)

• Quarterly VAT Declaration(Form 2550Q)

• Quarterly Income Tax Return for Individual (Form 1701Q)

• Quarterly Income Tax Return for Corporation, Partnership & Other Non-Individual Taxpayers (Form 1702Q)

• Annual Income Tax Return for Individual (Form 1701/1701A)

• Annual Income Tax Return for Corporation, Partnership & Other Non- Individual Taxpayers (Form 1702)

• Annual Registration Fee (Form 0605)

• Annual Registration Update - 8% IT

• Cash Disbursements Book

• Subsidiary Sales Journal

• Subsidiary Purchase Journal

• Statement of Financial Position

• Statement of Comprehensive Income

• Statement of Changes in Capital / Equity

• Statement of Cash Flows

SEC Reportorial Requirements

• Special Form of Interim Financial Statements for Lending Company (June and December)

• Special Form of Financial Statements for Lending Company (based on audited financial statements)

Other Industry

Lending / Franchising - With Employees

Sole Proprietor

Partnership/Corp.

Monthly PF STARTS AT

6,888.00

15,000.00

• Submission of Payroll Worksheet

• Monthly Remittance Form for Creditable Income Taxes Withheld Expanded (Form 0619E)

• Quarterly Remittance Return of Creditable Income Taxes Withheld Expanded (Form 1601EQ)

• Quarterly Alphalist of Payees (Alphalist)

• Issued Certificate of Creditable Tax withheld at Source (Form 2307)

• Annual Information Return of Creditable Income Taxes Withheld (Expanded)(Form 1604E)

• Monthly Remittance Form for Final Income Taxes Withheld (Form 0619F)

• Quarterly Remittance Return of Final Income Taxes Withheld (Form 1601FQ)

• Issued Certificate of Final Tax withheld at Source (Form 2306)

• Quarterly Alphalist of Payees (Alphalist)

• Annual Information Return of Income Payment Subjected to Final Withholding Taxes (Form 1604F)

• Quarterly Percentage Tax Return (Form 2551Q)

• Monthly VAT Declaration(Form 2550M)

• Quarterly VAT Declaration(Form 2550Q)

• Quarterly Income Tax Return for Individual (Form 1701Q)

• Quarterly Income Tax Return for Corporation, Partnership & Other Non-Individual Taxpayers (Form 1702Q)

• Annual Income Tax Return for Individual (Form 1701/1701A)

• Annual Income Tax Return for Corporation, Partnership & Other Non- Individual Taxpayers (Form 1702)

• Annual Registration Fee (Form 0605)

• Annual Registration Update - 8% IT

• Cash Disbursements Book

• Subsidiary Sales Journal

• Subsidiary Purchase Journal

• Statement of Financial Position

• Statement of Comprehensive Income

• Statement of Changes in Capital / Equity

• Statement of Cash Flows

SEC Reportorial Requirements

• Special Form of Interim Financial Statements for Lending Company (June and December)

• Special Form of Financial Statements for Lending Company (based on audited financial statements)

Other Industry

Lending / Franchising - With Employees

Sole Proprietor

Partnership/Corp.

Monthly PF STARTS AT

10,888.00

20,000.00

• Submission of Payroll Worksheet

• Monthly Remittance Form for Creditable Income Taxes Withheld Expanded (Form 0619E)

• Quarterly Remittance Return of Creditable Income Taxes Withheld Expanded (Form 1601EQ)

• Quarterly Alphalist of Payees (Alphalist)

• Issued Certificate of Creditable Tax withheld at Source (Form 2307)

• Annual Information Return of Creditable Income Taxes Withheld (Expanded)(Form 1604E)

• Monthly Remittance Form for Final Income Taxes Withheld (Form 0619F)

• Quarterly Remittance Return of Final Income Taxes Withheld (Form 1601FQ)

• Issued Certificate of Final Tax withheld at Source (Form 2306)

• Quarterly Alphalist of Payees (Alphalist)

• Annual Information Return of Income Payment Subjected to Final Withholding Taxes (Form 1604F)

• Quarterly Percentage Tax Return (Form 2551Q)

• Monthly VAT Declaration(Form 2550M)

• Quarterly VAT Declaration(Form 2550Q)

• Quarterly Income Tax Return for Individual (Form 1701Q)

• Quarterly Income Tax Return for Corporation, Partnership & Other Non-Individual Taxpayers (Form 1702Q)

• Annual Income Tax Return for Individual (Form 1701/1701A)

• Annual Income Tax Return for Corporation, Partnership & Other Non- Individual Taxpayers (Form 1702)

• Annual Registration Fee (Form 0605)

• Annual Registration Update - 8% IT

• Cash Disbursements Book

• Subsidiary Sales Journal

• Subsidiary Purchase Journal

• Statement of Financial Position

• Statement of Comprehensive Income

• Statement of Changes in Capital / Equity

• Statement of Cash Flows

SEC Reportorial Requirements

• Special Form of Interim Financial Statements for Lending Company (June and December)

• Special Form of Financial Statements for Lending Company (based on audited financial statements)