Pricing

Flexible Pricing Tailored to Your Needs

At Anantaks, we recognize that taxpayers' needs vary that's why we offer adaptable payment options with no subscriptions or lock-in periods required! Enjoy the most competitive packages with Anantaks.

SELF EMPLOYED 8%

Plan for individual taxpayers with 8% Income Tax Rate, Non-VAT registered, and no employees.

SELF EMPLOYED GRADUATED

Plan for Non-VAT individuals with Graduated Tax Rate and zero employees.

SELF EMPLOYED VAT

Plan for VAT-registered individuals with no employees.

ONLINE TAX CONSULTATION

Book a 30-minute online tax consultation with our seasoned tax experts or CPAs to address all your tax queries

Php 1,500.00

PROFESSIONAL SERVICES

For individuals, sole proprietors, or corporations seeking CPA for preparation and filing services for compliance.

FREE LIVE TAX CALCULATIONS

Know which BIR forms to file with real-time tax dues calculations at no cost.

No automatic subscription. No hidden charges.

SELF EMPLOYED 8%

Plan for individual taxpayers with 8% Income Tax Rate, Non-VAT registered, and no employees.

SELF EMPLOYED GRADUATED

Plan for Non-VAT individuals with Graduated Tax Rate and zero employees.

SELF EMPLOYED VAT

Plan for VAT-registered individuals with no employees.

ONLINE TAX CONSULTATION

Book a 30-minute online tax consultation with our seasoned tax experts or CPAs to address all your tax queries

Php 1,500.00

PROFESSIONAL SERVICES

For individuals, sole proprietors, or corporations seeking CPA for preparation and filing services for compliance.

FREE LIVE TAX CALCULATIONS

Know which BIR forms to file with real-time tax dues calculations at no cost.

No automatic subscription. No hidden charges.

SELF EMPLOYED 8%

Plan for individual taxpayers with 8% Income Tax Rate, Non-VAT registered, and no employees.

SELF EMPLOYED GRADUATED

Plan for Non-VAT individuals with Graduated Tax Rate and zero employees.

SELF EMPLOYED VAT

Plan for VAT-registered individuals with no employees.

ONLINE TAX CONSULTATION

Book a 30-minute online tax consultation with our seasoned tax experts or CPAs to address all your tax queries

Php 1,500.00

PROFESSIONAL SERVICES

For individuals, sole proprietors, or corporations seeking CPA for preparation and filing services for compliance.

FREE LIVE TAX CALCULATIONS

Know which BIR forms to file with real-time tax dues calculations at no cost.

No automatic subscription. No hidden charges.

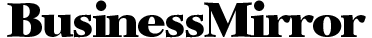

Demo

See how your online tax compliance is made simple by Anantaks. Built by tax-experts for the non-tax expert.

Affordable | Easy-to-Use | Accurate | Free Onboarding Support | Month-to-Month Contract

I'm ready to be TAX Compliant.

Tax Schedules for the month

October

| Su | Mo | Tu | We | Th | Fr | Sa |

|---|---|---|---|---|---|---|

|

1

|

2

|

3

|

4

|

5

|

||

|

6

|

7

|

8

|

9

|

10

|

11

|

12

|

|

13

|

14

|

15

|

16

|

17

|

18

|

19

|

|

20

|

21

|

22

|

23

|

24

|

25

|

26

|

|

27

|

28

|

29

|

30

|

31

|

|

1601CMonthly Remittance ReturnFor VAT and Non-VAT individuals, partnerships, or corporations |

|

2550QQuarterly Value-Added Tax ReturnFor VAT individuals, partnerships, or corporations |

|

2551QQuarterly Percentage Tax ReturnFor non-VAT individuals, partnerships, or corporations |

|

1601-EQQuarterly Remittance ReturnFor VAT and Non-VAT individuals, partnerships, or corporations |

|

1601-FQQuarterly Remittance ReturnFor VAT and Non-VAT individuals, partnerships, or corporations |

We do everything tax

Legitimate and Secure

Our trusted online tax system, developed by experts, is BIR-certified and compliant with the Philippines' Privacy Act for enhanced security.

Taxes Made Simple

Tailored for non-tax experts, our user-friendly platform simplifies tax prep and filing. Input income and expenses for automated tax processing in minutes.

Value-packed Pricing

Explore affordable plans for seamless tax compliance, offering options to file online, access consultations, or enlist a CPA's expertise.

Automated Tax Calculation

Our expertly designed online tax system ensures seamless tax filing. With just a few clicks to input your income and expenses, watch as your tax dues are automatically computed real time.

Effortless Form Generation & Filing

Our system identifies required BIR forms, computes tax dues, and generates accurately filled-out forms. It electronically files to the BIR and generates books of accounts automatically.

Secure Payment Gateway

Simplify payments and save time with our secure gateway, offering trusted options like Online banking, PayPal, and GCash.

Waiver: The accuracy of the tax preparation is dependent on the the taxpayers declared income, expenses, and other information he/she inputted in the system. Kindly provide all accurate details. Anantaks only use computation based on Philippine Tax regulations and rules. Taxpayers using Anantaks agree to hold Anantaks, its company Ananta Solution Corp., its owners, heirs, employees, and 3rd party suppliers, free from any liability that may arise from their use of Anantaks. Please refer to the Terms and Conditions of Anantaks.

See More