FAQs

What is Anantaks?

Anantaks is the most RELIABLE online tax preparation and filing tool in the Philippines today! Don’t fear tax preparation and filing! Anantaks will precisely compute it for you in minutes!

I want to join and sign up to Anantaks, what will I do?

Signing up to Anantaks is so easy. You just have to follow these steps:

- Set up your account at https://anantaks.com/login/signup

- Type your Name/Business Name, E-mail Address, and Password

- Check you E-mail for the verification link. After you verify your link,

- You will be redirected to Login page https://anantaks.com/login/client

- Enter your username and password.

You can now start your tax preparation and filing with Anantaks.

What will I do after I signed up to Anantaks?

Register your business

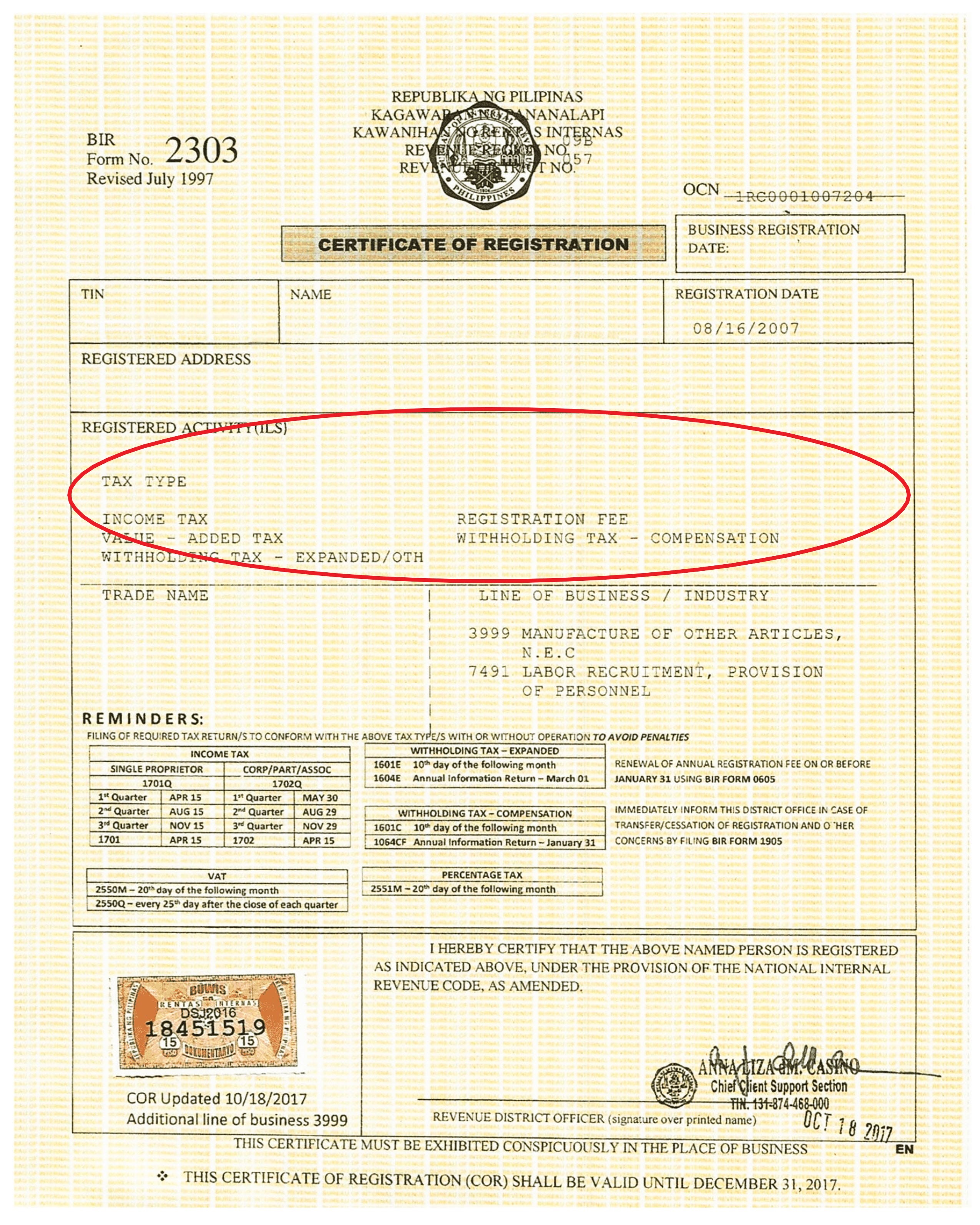

As NON-VAT registered, you have to have:

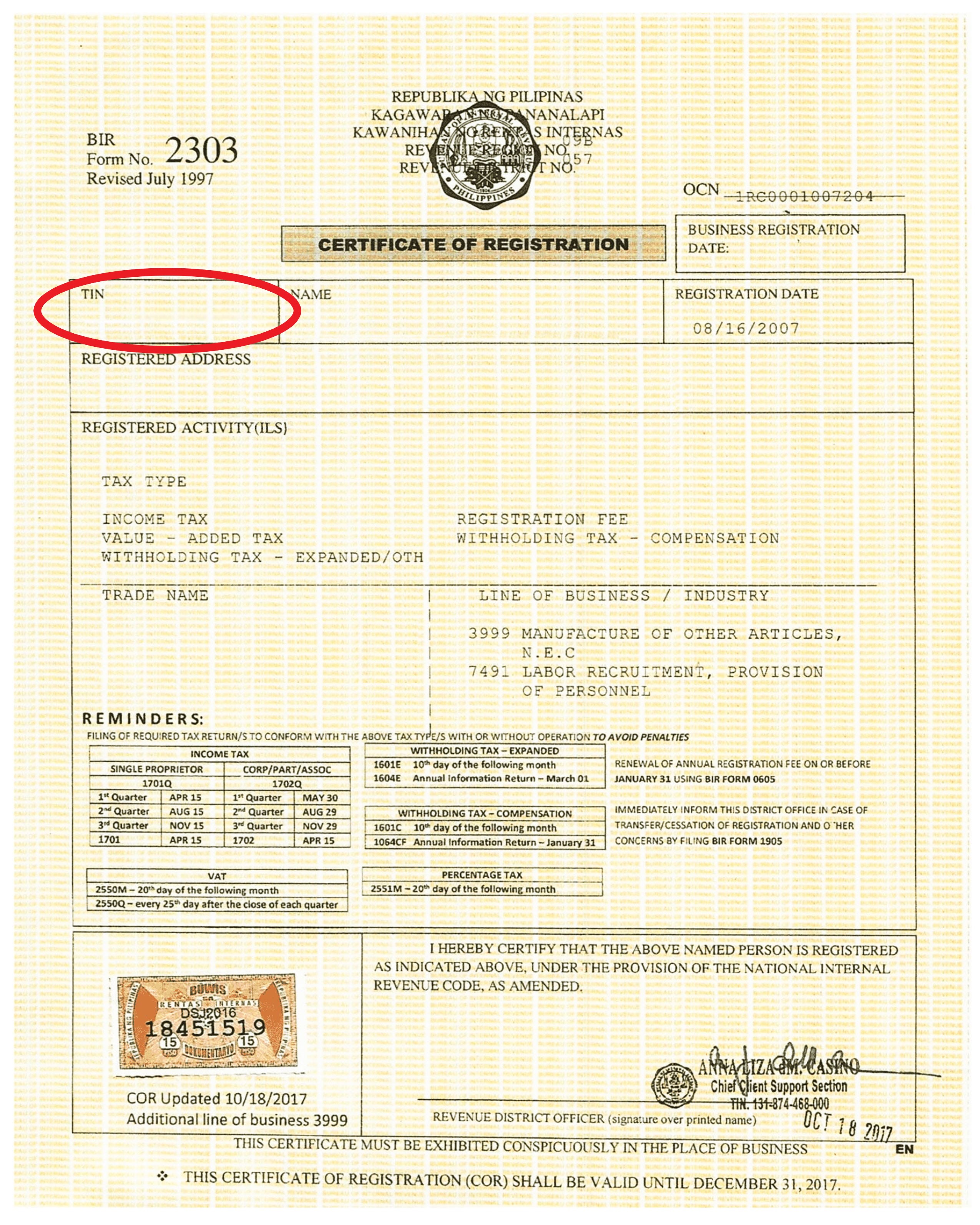

- A. Bureau of Internal Revenue (BIR) Certificate of Registration (COR) form 2303

- B. Income with Official Receipt

- C. Expenses with Official Receipt

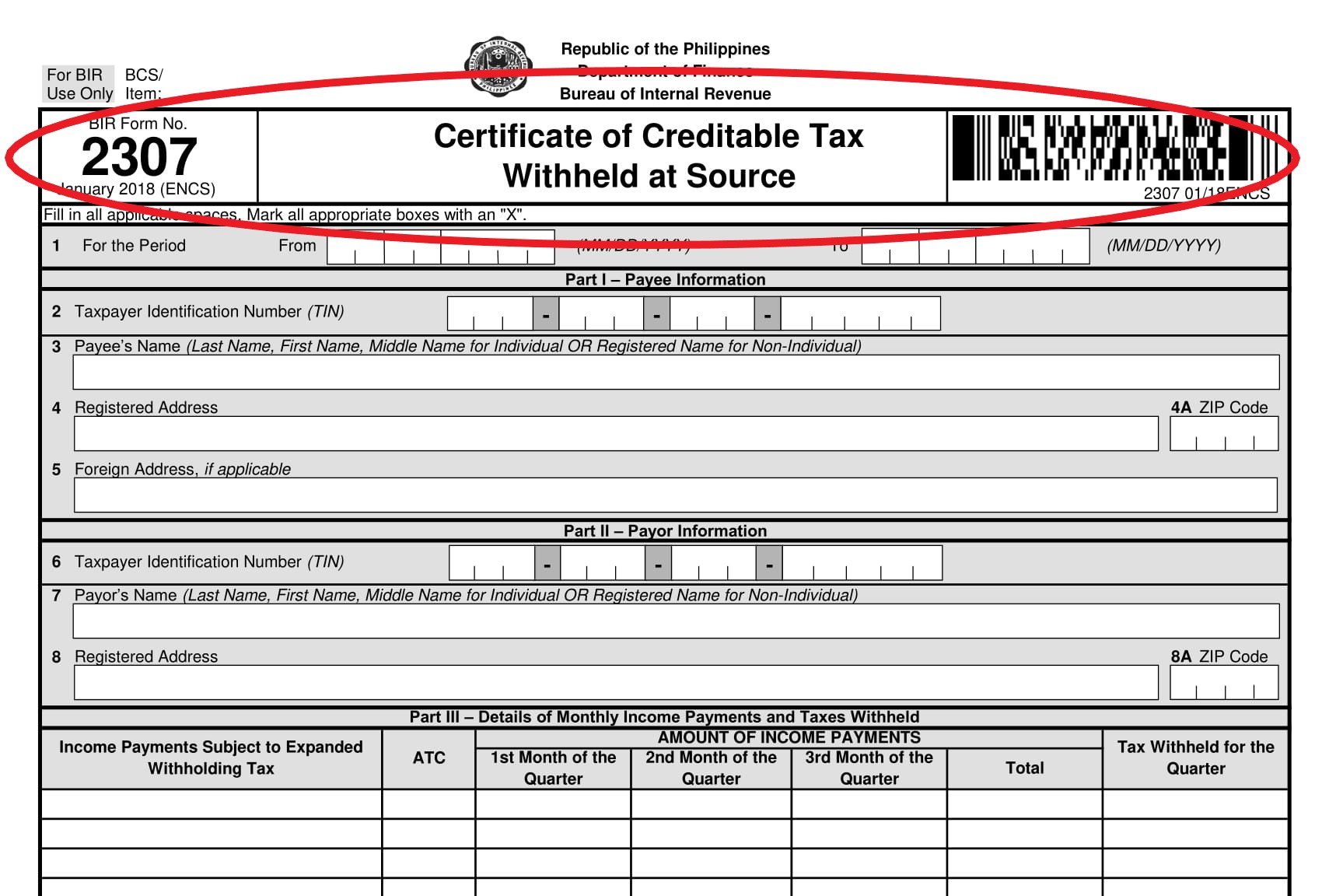

- D. Withholding Tax form 2307 if available

- F. Other forms need to file will appear on Tax dues

For taxpayers using the 8% Flat Income Tax Rate

- Filing For:

- Income Tax (1701Q/1701A/1701)

- Annual Registration Fee (BIR Form 0605)

- Attachment/s included:

- Summary of Alphalist of Withheld Taxes (SAWT)

- Books of Accounts

For taxpayers using the Graduated Income Tax Rate

- Filing for:

- Percentage Tax (2551Q)

- Income Tax (1701Q/1701A/1701)

- Annual Registration Fee (BIR Form 0605)

- Attachment/s included:

- Summary of Alphalist of Withheld Taxes (SAWT)

- Books of Accounts

Steps in Business Registration

- Fill in all the information needed from your BIR Certificate of Registration

- Provide all the details needed under Basic Information, Setting and documents.

- Go to Cashflow Tab. Add all your Income and Expenses from your business. Anantaks will automatically compute all your tax dues

- If you have Certificates of Withholding Tax BIR Form 2307 on hand, go to Withholding Tax and provide the details

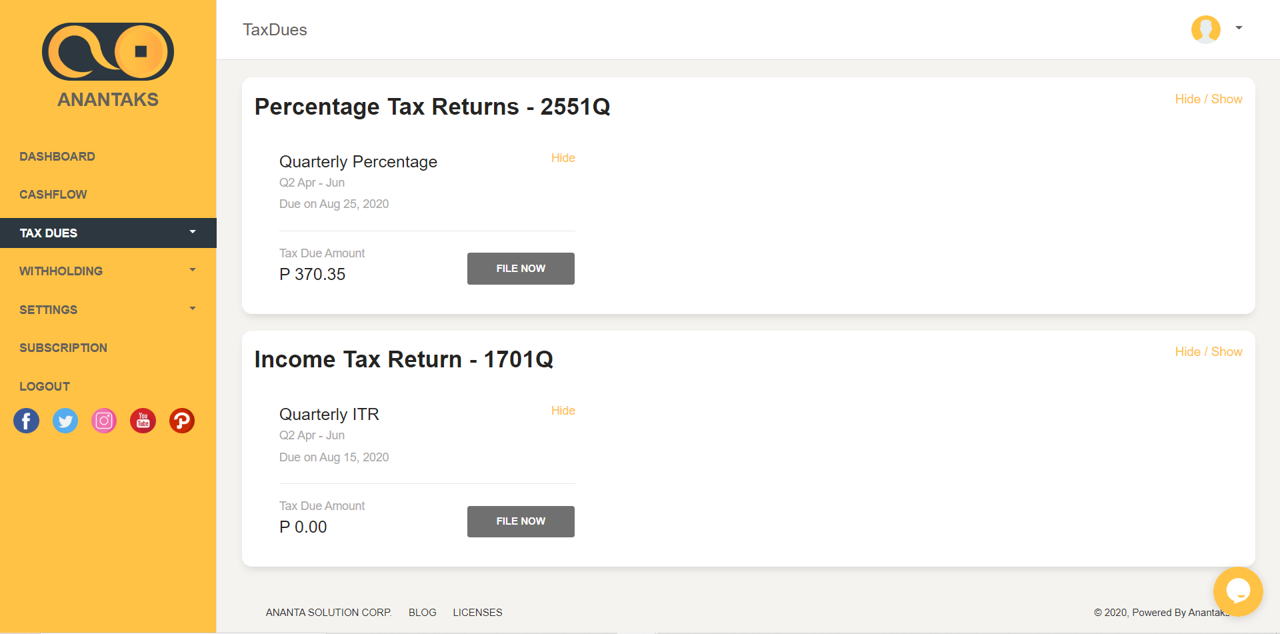

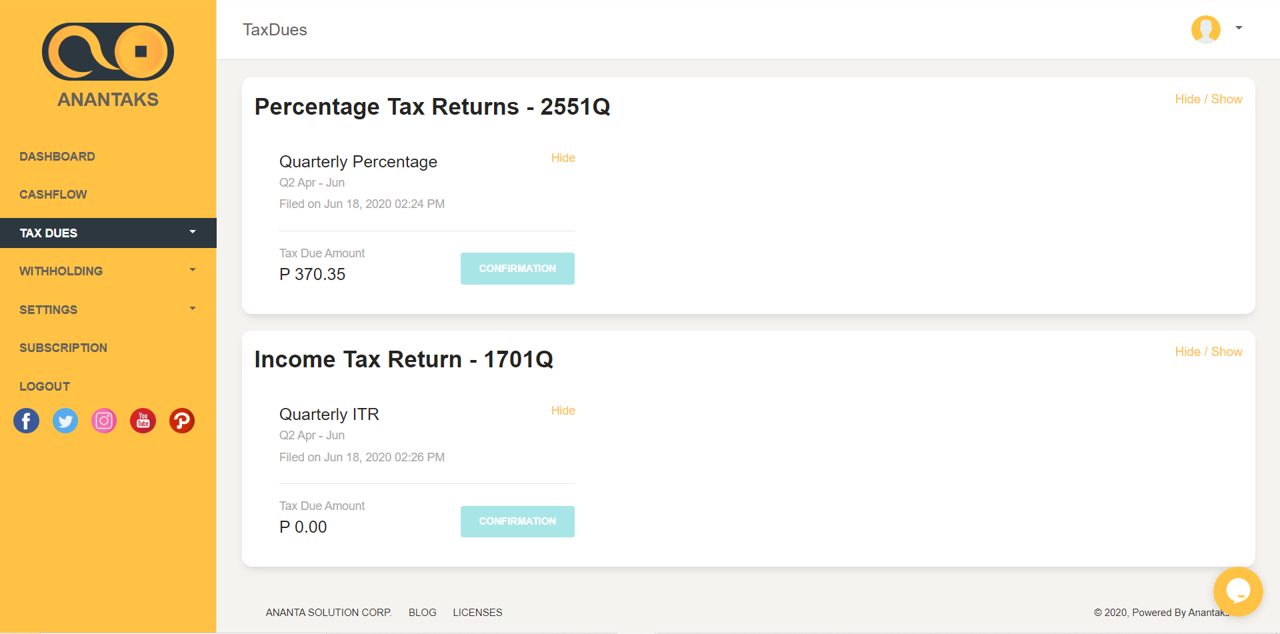

- Go to Tax dues, click FILE NOW and Pay for the taxes you want to pay.

What TIN will I use?

The TIN number indicated in your Certificate of Registration for the Business you are registering.

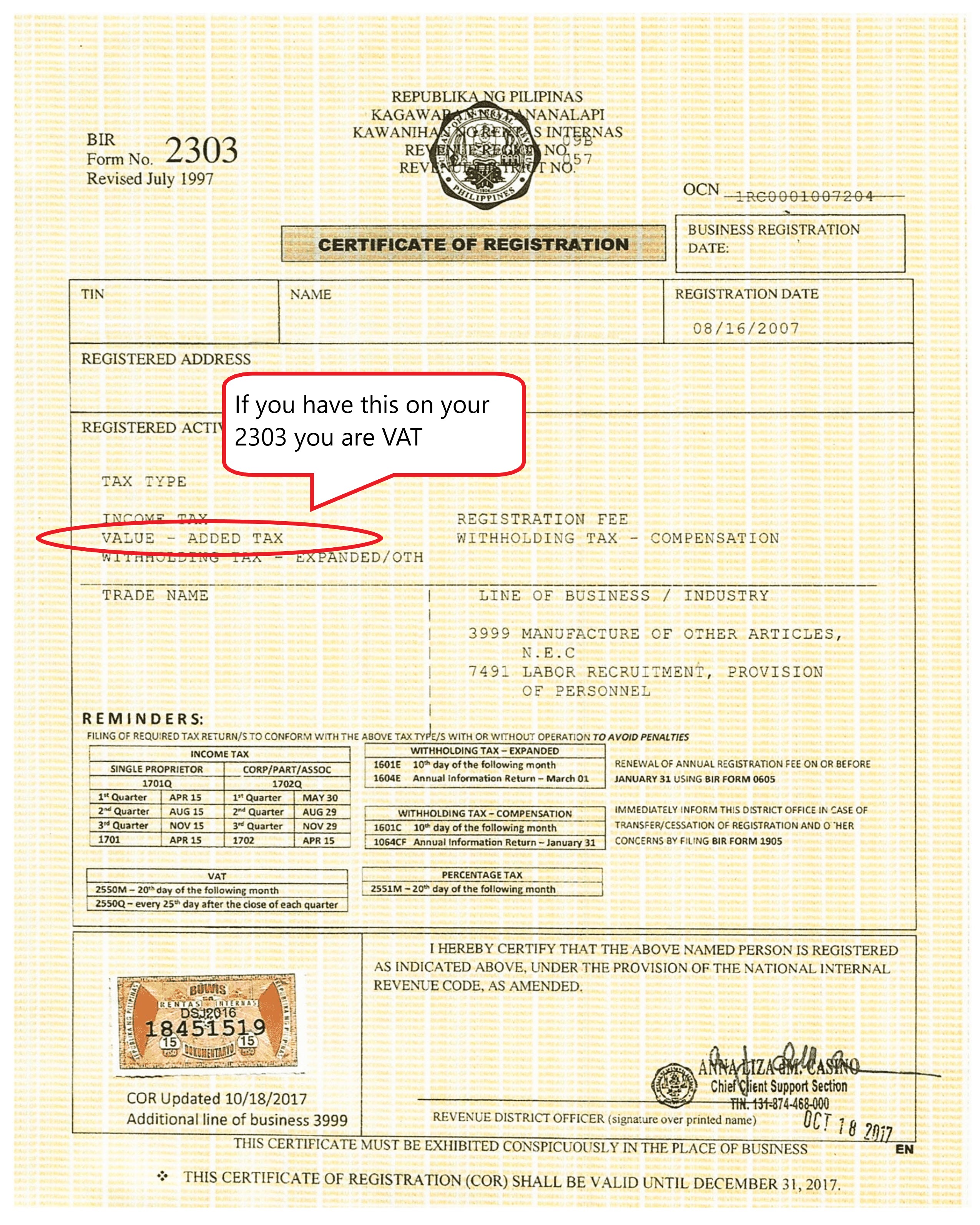

How will I know if I am a VAT or NON-VAT Registered?

Check your TAX TYPE from your Certificate of Registration (COR), Registered Activity (IES)

What package will I choose?

You may check our package description:

Self Employed

- Package for:

- Self-employed taxpayers with annual income less than Php3,000,000.00

- Example: Doctors, Lawyers, Real Estate Agents, Insurance Agents, Consultants, Freelance Artists, and Celebrities among others.

TNVS (Transportation Network Vehicle Services)

- Package for:

- Package for taxpayers who are TNVS operators/drivers

Small Companies

- Package for:

- Small businesses with annual income less than Php 3,000,000.00, and prefers a percentage tax

To know more, click this link

Sole Proprietor

Sole Proprietor is a person who is the exclusive owner of a business, entitled to keep all profits after tax has been paid but liable for all losses.

Professional

Professional refers to anyone who earns their living from performing an activity that requires a certain level of education, skill, or training.

Freelancer

Doesn’t usually have employees, but may outsource work for specific projects

Partnership

Agreement between two or more individuals to carry on a business as co-owners

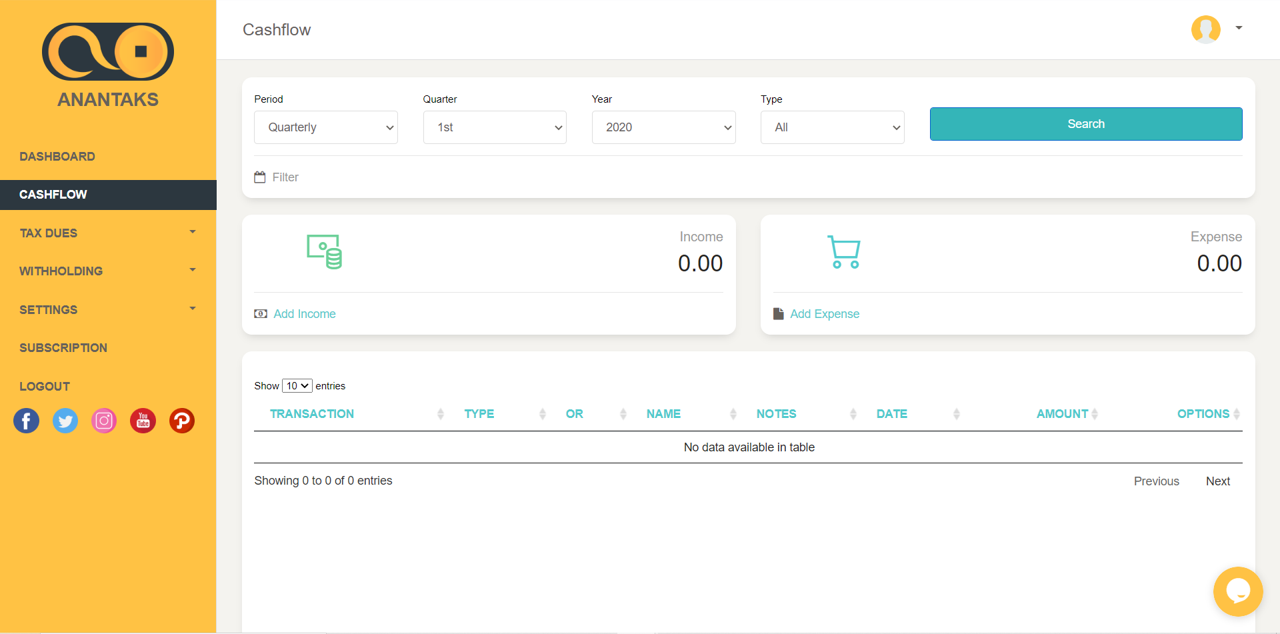

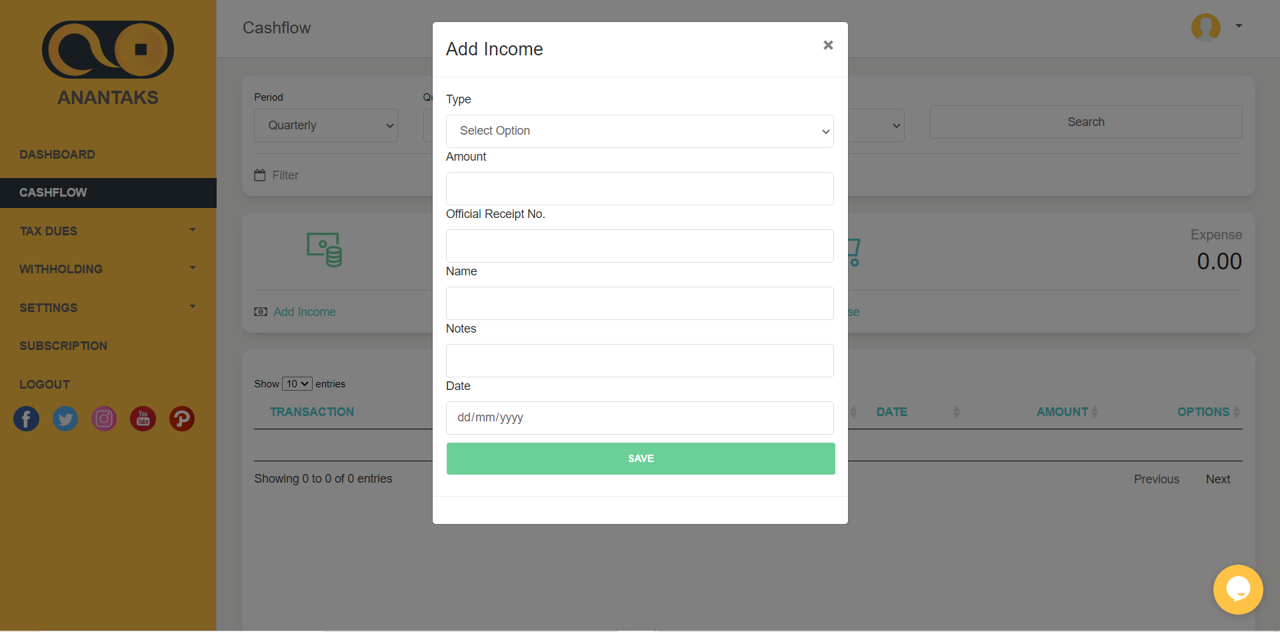

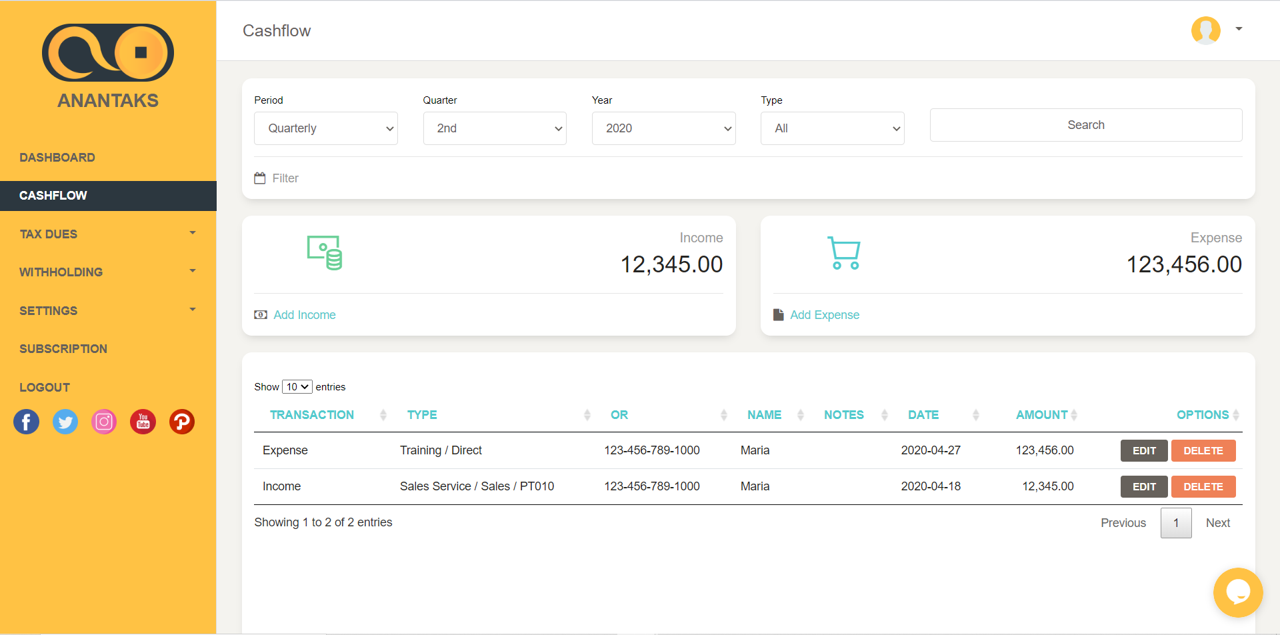

What will I do to Cashflow?

This is where you can track your income and expense for the month, quarter or year.

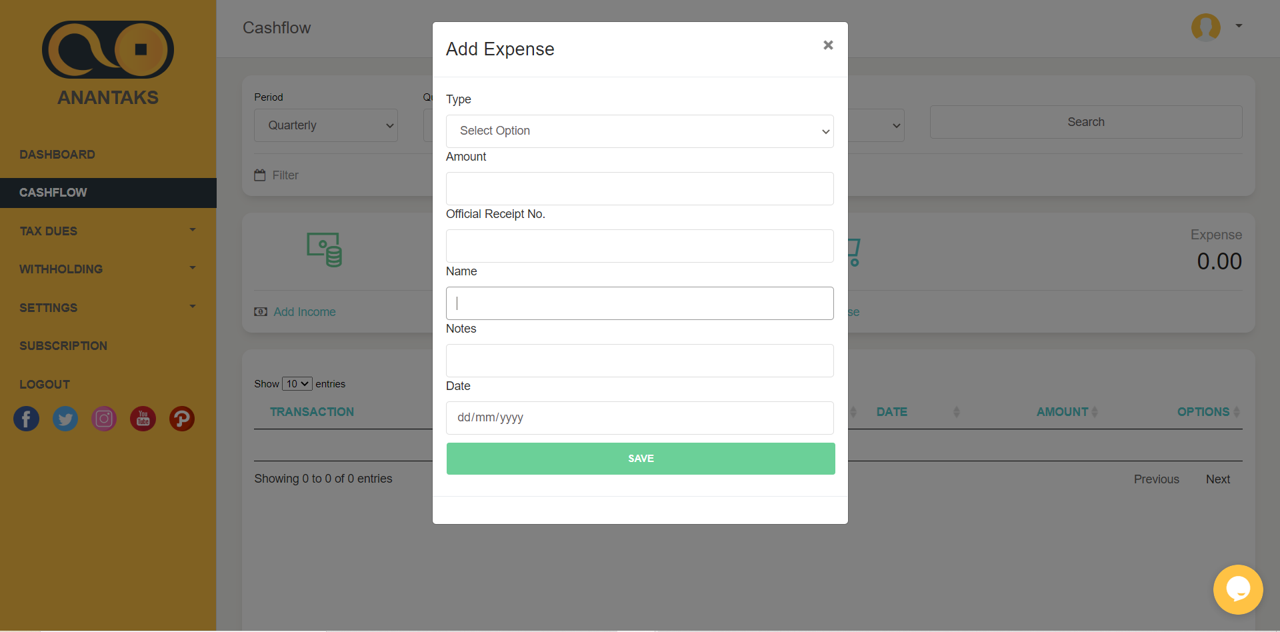

This is how to add your income and expense:

- Click for the Period, Quarter or Year you are need for filing then click search.

- Click Add Income and input all details from your Official Receipts/Sales Invoice for that period.

- Click Add Expense and input all details from your Expenses for that period

- All income and expenses for a given period will appear here. You can still edit or delete on this stage until you are done filing.

What are Tax Dues?

Tax dues are the taxes you need to file and pay to BIR. (Bureau of Internal Revenue)

Note: None settlement of the Tax Due on time will be subjected to BIR fines and penalties.

What is Past Filing?

Past filing is where all filed Taxes appears.

What is Withholding Tax?

Withholding tax is the tax which is withheld (deducted) by the payors referred to as withholding agent from payments to the payees for the sale of the goods or services and remit the same to the Bureau of Internal Revenue. This tax is an ADVANCE collection of tax and is creditable against the income tax payable of the payees.

The Certificate of creditable withholding tax (BIR Form 2307) is attached to the quarterly/annual income tax return to allow the amount of withholding tax as tax credit

BIR Form 2307 (Certificate of Creditable Tax Withheld At Source)

BIR Form 2316 - Certificate of Compensation Payment/Tax Withheld / For Compensation Payment With or Without Tax Withheld

Note: For Mixed Income Taxpayers, they need to upload the BIR Form 2316 and Form 2307 if both are applicable or any of the 2 Forms)

SAWT - Summary Alphalist of Withholding Taxes: Report based on 2307

This will be provided to Taxpayer/Subscriber upon payment/filing together with BIR Form 1701Q/1701A.

Where do I get BIR Form 2307?

This is being issued by the withholding agent / payor /seller for sale of goods and services

Can I use credit card for payment for my Tax Dues?

Yes. You can pay using your credit card via PayPal. Just click PayPal for your payment option.

What are the tax forms I need to file and pay?

All the types of taxes and Forms you need to file and pay are listed in your Certificate of Registration (COR) Form 2303 including the deadlines.

I already paid for the subscription, why do I need to pay again after I clicked file now?

Subscription payment is for the use of the Anantaks system. Payment after subscription is for the Tax due computed as required by the Bureau of Internal Revenue indicated in your Certificate of Registration (COR) If you have zero (0) amount of tax due, it will filed to BIR without any payment.

I already filed and paid my tax and I forgot to include the Withholding Tax, what will I do?

If you have Form 2307, just upload it and you may apply it as your tax credit for the next quarter or upon annual income tax filing.

I want to know more about tax, can I have options to talk to any person or consultant?

Yes. You can reach us via:

- Facebook messenger

- You can also talk to us via chat, it is at the lower right corner of Anantaks Website.

- We also have consultation, a video call where you can talk directly to our Tax Consultants for all your concerns with regards to your taxes.

We are trying to be as responsive as we can to address all your concerns.